Our Services

IWM is a fee-based financial planning firm. This means our compensation is a percentage of the assets under management; we don’t receive commissions on products. Our clients are our sole source of compensation. This structure aligns our goals and eliminates conflicts of interest. The only services not covered by IWM’s fees are estate planning and tax preparation.

Financial Planning

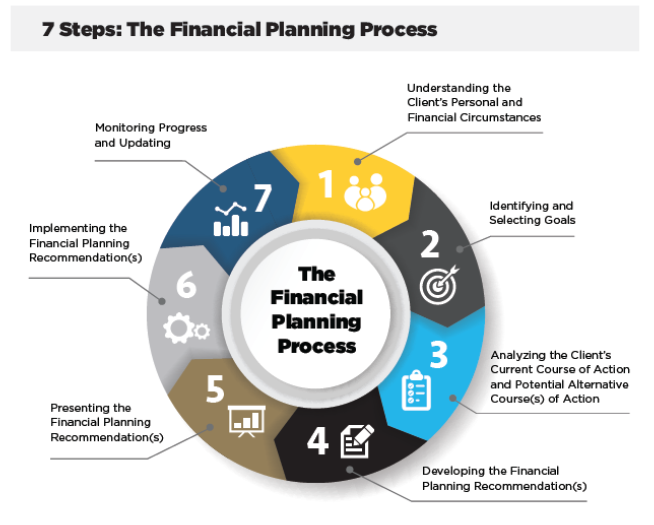

When performing financial planning, we follow the Code of Ethics, Standards of Conduct and Practice Standards of the CFP Board. Financial plans are developed using eMoney, a powerful web-based app. Within eMoney, our clients have a portal containing their personal financial plan. Clients can link investment accounts, mortgages, employer retirement plans and credit cards to the portal. Account balances are updated daily providing clients with a real-time plan. The process of making plan updates is streamlined.

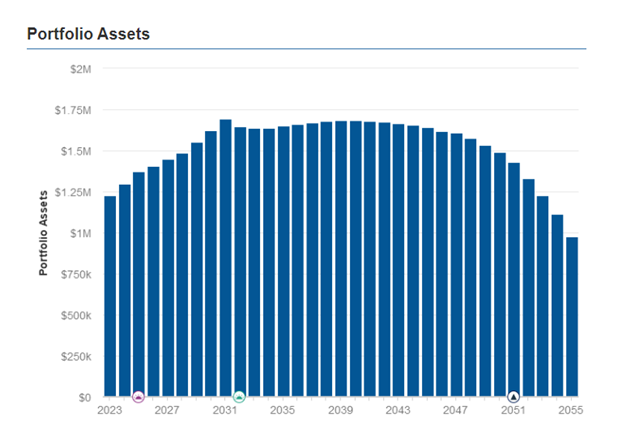

With eMoney, multiple scenarios and “what if’s” can be modeled. We use the app to understand the impact of lifespans, retirement ages, inflation rates and rates of return on investments. We also model Social Security claiming strategies and retirement account distribution strategies. The models provide clients nearing retirement with peace of mind.

We review your plan periodically to determine if your savings, investing and spending levels are on track with the original plan. We can also update the plan when you experience significant life events like the birth of a child, a job change, a marriage or a divorce. We capture and ensure follow through on any required actions. At the end of the day, we want you to experience the peace of mind that comes with knowing you are on track.

Retirement Planning

It’s common to feel anxious when deciding to step away from a full-time profession and income. Our process takes the guesswork out of retirement planning. When building a retirement plan, we evaluate:

- Budget for expenses

- Maximizing investment income

- Minimizing taxes on investment income

- Distribution strategies by account type

- Roth IRA conversion strategies

- Social Security and the optimum age to claim

- Medicare coverage options

- Pensions

- Cash flow in retirement and assets at the end of life

Investment Management

Investments are core to your plan. We will complete an Investor Policy Statement (IPS) to assess your risk tolerance, investing goals and time horizon to select the best asset allocation. Model portfolios constructed with mutual funds and exchange-traded funds (ETF) will be selected for each account. Depending on the client and account size, investment plans may include individual stocks and bonds. We have a disciplined process that incorporates:

- Tactical changes to asset allocation based on economic cycle and market conditions

- Model portfolios that optimize risk and return

- Evaluation of models by Fidelity, Capital Group and BlackRock

- Best in class mutual funds, ETFs, stocks and bonds

- Diversification by asset class and subclass to reduce risk

- Reinvestment of dividends leading to compounded growth

- Rebalancing to capture gains and avoid portfolio drift

- Private placement funds often limited to high-net-worth (HNW) investors

Insurance

Insurance is an important risk management technique to protect your loved ones and your assets. We will identify the insurance types and coverages needed when we build your plan in eMoney:

- Life insurance, whole and term

- Disability insurance

- Long-term care insurance

- General liability insurance

Tax Planning

Minimizing tax burdens while complying with tax laws is another subject we consider when constructing financial plans and managing investments. Items we consider include:

- Retirement accounts such as self-employed 401(k)s, SEPs and IRAs

- Roth IRA conversion strategies

- Municipal bonds in taxable accounts

- Holding period for securities to receive long-term capital gains tax treatment

- Tax-loss harvesting in taxable accounts

- Health Savings Accounts (HSA) to reduce taxes and fund healthcare

- Using highly appreciated securities to fund charitable giving

Estate Planning

Estate planning for end-of-life transitions involves the transfer of personal responsibilities and financial assets and liabilities. A well-designed plan will lessen the burden on loved ones, support efficient transfers, avoid probate, maintain privacy and minimize taxes. Our team can help you:

- Define your family’s needs

- Inventory investment accounts, deeds and life insurance

- Prepare wills, trusts and powers of attorney

- Ensure proper titling and beneficiaries

- Understand your state’s estate tax laws

- Review potential for gifting

Education

We all recognize the escalating cost of education. It is important to start saving early and investing wisely. eMoney maintains links to the education costs for a large number of colleges and universities to help us establish plans that are continuously updated. Our real-life experience in funding educations will be to your benefit as we consider:

- 529’s and UTMA accounts

- Cost sharing ideas for parents and children

- Parental loans and loan forgiveness